Does homeowner’s insurance cover me if damage is caused by wind?

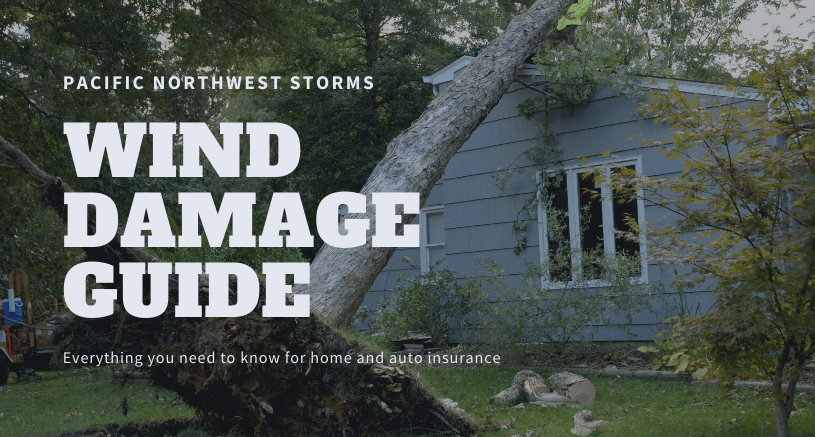

When the winds start howling, it is understandable to be concerned about your home, car, and recreation vehicles that could be damaged. Here in the Pacific Northwest, we are lucky to be surrounded by beautiful forests. But when those trees come crashing down, you want to make sure your insurance protects you.

We live here in the greater Seattle region and know what it’s like when a windstorm comes whipping through the Puget Sound. Whether it is gales in the Columbia Gorge or the jet stream blowing through the Strait of Juan De Fuca after a thorough soaking from a Pineapple Express, we are prepared to help with storm damage.

What is wind damage?

Typical home insurance policies usually protect your house in case of damage from the wind. Your policy probably includes property damage caused by tornadoes, hurricanes, and high wind events. Coverage usually covers your personal items damaged when a roof or wall is damaged due to wind.

But there may be exclusions depending on where you live. Always check your policy documents or review them with your agent to make sure you have proper coverage. It is better to know beforehand than after the storm has passed through.

During a wind event, damage to your vehicle is primarily caused by something falling or hitting your car, causing damage. In this case, your coverage isn’t about if your auto policy includes wind protection but whether you have comprehensive coverage. Comprehensive insurance coverage covers most other damages besides a collision that could happen to your vehicle.

Example: Your car is hit by a tree branch that fell during a windstorm; comprehensive would cover you.

There are a few exclusions, so be sure to discuss with your agent what those might be.

Frequently asked questions

If your home or vehicle is damaged in a windstorm, here are answers to the questions we receive the most often.

Does insurance cover me if a tree fell on my house?

Rest easy; this is what insurance is for. Homeowners’ insurance will help you repair your home as long as there are no exclusions on your policy. Make sure you keep an adequate inventory of your possessions in your home just in case those are damaged due to the tree so you can get those replaced as well.

My neighbor’s tree fell on my property; who is responsible?

The answer is, most of the time, quite simple. Whoever owns the damaged property is responsible for getting the damage repaired – not the owner of the tree. You will need to contact your homeowner’s insurance company and file a claim.

Proving any evidence of negligence on the part of the tree owner is exceedingly rare. Trees die but can remain healthy and standing for many years. Have a conversation about the risks it poses and the potential harm it could cause if it fell. Perhaps this will remedy the problem. If you or your neighbor has a tree that has died and you’re worried about it, you should call out an arborist. If your tree falls on your neighbor’s house, who is responsible

Just like if your neighbor’s tree falls and damages your property, if your tree falls on the other side of the fence, your neighbor will need to contact their insurance company and file a claim.

What happens if my neighbor’s tree falls on my car?

Whether your car is parked on the street, in your driveway, or even at your neighbor’s house, you will need to file a comprehensive claim on your auto insurance. As mentioned above, this coverage is for when your car is damaged in something other than a collision.

Check your auto policy and make sure you have comprehensive coverage. Comprehensive coverage is not mandatory coverage and may not be active on your policy

Does homeowner’s insurance cover if wind damages my fence?

Home insurance may help cover the repair cost, but don’t count on them to pay for the entire fence to be replaced. The insurance company may hire a contractor to come to repair the damaged section and only that section. In the end, you might save money fixing or hiring yourself after taking into account your deductible.

Does home insurance cover roof damage from wind?

Same as your fence. If some shingles have been blown off, the company might repair those shingles but will not replace your entire roof. Consider your deductible and the number of claims you’ve had and how that might impact your future rate.

How to stay safe

If you know a wind-packed storm is coming, here are some steps to protect yourself and your property:

- Park your vehicles in your garage or a covered location.

- Develop a plan and determine the safest place for your boat in or out of the water.

- Bring in or strap-down garbage cans, patio furniture, grills, and other potentially wind-borne objects.

- If necessary, board windows and glass doors minimize damage from broken glass.

- Secure and shut off your outdoor pool.

- Perform regular maintenance on any trees on your property. Be sure to hire a certified arborist for this task who will know your local rules and regulations for trees.

- If you live in a manufactured home, make sure your straps, tie-downs, and anchors are prepared for the wind event.

Conclusion

If you have questions about your home, auto, or commercial insurance, call us. We have locations throughout Washington State in Olympia, Centralia, Port Angeles, and Marysville. We have years of insurance experience and can help you insure everything from your home to your auto or business Insurance. We live where you do and are an independent insurance agent, so we can help you find the right company to fit your needs.

Get a Quote

Cross Insurance represents the top-rated insurance companies in Washington. We will compare pricing and coverage options finding you the best policy for your needs. Call us at: 888-438-6708 or click the button to the right to send us a message for your quote.