We all know the importance of having a smoke detector in our home, but what about a carbon monoxide detector?

We all know the importance of having a smoke detector in our home, but what about a carbon monoxide detector?

Carbon monoxide is a colorless, odorless gas that can be lethal. Carbon monoxide can build up in your home whenever you burn fuel from a stove, grill, furnace, fire place or from your vehicles in the garage. Obviously, we need to use these appliances every day, as well as drive a vehicle, so how can we keep safe?

Simple tips to prevent carbon monoxide poisoning

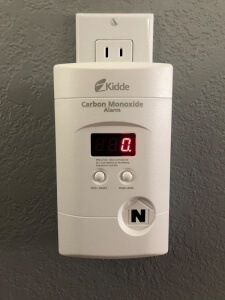

- Install a carbon monoxide detector on every level of your home. Check the batteries every 6 months, however, it should alert you with a beep with batteries are low.

- Ensure you get your fuel burning appliances checked every year by a qualified technician. You should get in the habit of looking for rust on vents or loose/disconnected pipes on appliances like your water heater, heating system or any other gas, oil or wood/coal burning appliance.

- Use portable gas stoves or burn charcoal outside only.

- Keep generators outside and away from open windows only. Using them in a garage or carport can be dangerous.

- Don’t attempt to heat your house temporarily by turning on your oven or gas stove.

- Get your chimney checked every year. Debris can block your chimney and cause carbon monoxide to build up in your home. You can check your chimney yourself for any cracks.

- Never leave your car running while it sits in the garage.

Did you know they make a battery operated combination detector for both a smoke and carbon monoxide? Combination detectors can save space and batteries in addition to lives.

Even a single carbon monoxide detector in your home could save lives. If you rent a home or apartment that does not currently have a carbon monoxide detector, ask your landlord to provide one. Many states require that homes have them installed. Review your state laws here.

If you have questions about your home or renters insurance, contact our agency. We can go over your current coverage or provide you with an insurance quote.

Many insurance policies contain coinsurance clauses which require policyholders to purchase an amount of insurance that accurately reflects the value of their insured property. If less than a certain percentage of the accurate value is purchased, policyholders may not be able to fully recover in the event of a loss.

Many insurance policies contain coinsurance clauses which require policyholders to purchase an amount of insurance that accurately reflects the value of their insured property. If less than a certain percentage of the accurate value is purchased, policyholders may not be able to fully recover in the event of a loss.