Flood Insurance and Sewer Backup Insurance – Not the same thing.

Floods are the most devastating natural disaster in the United States each year causing billions in losses and displacing thousands. While flooding is a common concern for those near rivers and streams, all homes in the United States can be caught off-guard by floods. When it comes to flood insurance, it is important to understand what flood insurance is and what is covered. Many people think flood insurance is anything to do with water in their home. This is far from the truth. Floods are defined as surface water that enters your home from the outside – not to be confused with a leaky roof or a broken pipe, loose toilet or other plumbing related issue. Another issue altogether is sewer backup with may or may not be covered depending on what caused it to occur.

Floods are the most devastating natural disaster in the United States each year causing billions in losses and displacing thousands. While flooding is a common concern for those near rivers and streams, all homes in the United States can be caught off-guard by floods. When it comes to flood insurance, it is important to understand what flood insurance is and what is covered. Many people think flood insurance is anything to do with water in their home. This is far from the truth. Floods are defined as surface water that enters your home from the outside – not to be confused with a leaky roof or a broken pipe, loose toilet or other plumbing related issue. Another issue altogether is sewer backup with may or may not be covered depending on what caused it to occur.

Let’s take a closer look at these policies:

Flood Insurance: Flood insurance covers your property and contents from damages that occur when water from outside the home enters the home. Beit a heavy rainstorm, a clogged drain in the street or even a hurricane that causes a tidal surge that backs up streams and rivers.

- Cost: According to floodsmart.gov, the average flood insurance policy costs around $700 a year. Depending on your area and whether you’re in a flood prone area, your costs can be higher or lower.

- What’s covered: The typical flood insurance policy will cover your building and the contents. Be sure to discuss contents coverage with your agent to ensure you have enough coverage. The price of the policy will be largely determined by how valuable your items are and how much coverage you need.

- When to buy: Flood insurance requires a 30 day waiting period. The best time to buy a flood insurance policy is as soon as you decide you want it.

Water & Sewer Backup Coverage: Sewage backup insurance is not included with a standard homeowner’s insurance policy. Sewage backup occurs for many reasons, but ultimately, what is happening is there is a blockage that causes water to reverse course and push up into your sinks, bathtubs or other outlets. This can be a smelly, filthy event and one you want to be sure to discuss with your agent. Believe it or not, this is a somewhat common occurrence.

- Cost: Cost always varies, but typically a sewer backup endorsement will run you under $100. Be sure to ask your agent about different policy options.

- What’s covered: You purchase specific amounts of covers, such as $10,000 or $15,000. This helps cover the cost of cleaning the damage caused from the backup as well as replacing carpets, drywall, and even cleaning or replacing ducts.

- When to buy: Water and sewage backup occurs everywhere. There is no real good indicator or when this event will occur, so protecting early is critical.

We understand insurance is confusing, so if you still have questions, feel free to call one of our licensed agents and ask to speak about flood or sewage backup coverage.

If you have questions about your insurance, call the insurance agents at Cross Insurance Agency. They have locations throughout Washington State in Olympia, Centralia, Vancouver and Marysville. They have years of insurance experience and can help you insure everything from your home to your auto or business Insurance. They live where you do and are an independent insurance agent, so they can help you find the right company to fit your needs. You can also check out their website, 24/7.

Driving hazards present themselves daily and can occur year-round in every state. But, would you know what to do in the event a driving hazard presented itself?

Driving hazards present themselves daily and can occur year-round in every state. But, would you know what to do in the event a driving hazard presented itself? If you’re like 2 out of every 3 renters who rent a home, apartment or other dwelling, you don’t carry a renters insurance policy. The reason for not carrying renters insurance varies, but it is important to understand that your landlord is not responsible for your personal belongings if they are damaged, stolen or otherwise. You alone are responsible for your things, so protecting them with a renters insurance policy is important.

If you’re like 2 out of every 3 renters who rent a home, apartment or other dwelling, you don’t carry a renters insurance policy. The reason for not carrying renters insurance varies, but it is important to understand that your landlord is not responsible for your personal belongings if they are damaged, stolen or otherwise. You alone are responsible for your things, so protecting them with a renters insurance policy is important. Every home in the US is vulnerable to mold damage and now that we’re coming into the cooler winter months, mold can thrive. Mold really needs one thing to grow: moisture.

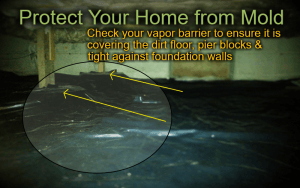

Every home in the US is vulnerable to mold damage and now that we’re coming into the cooler winter months, mold can thrive. Mold really needs one thing to grow: moisture. Fall is a great time to consider disaster preparedness and to take a look at your family’s emergency kit. While disasters can happen anywhere, whether natural or man-made, it is important that your family be prepared.

Fall is a great time to consider disaster preparedness and to take a look at your family’s emergency kit. While disasters can happen anywhere, whether natural or man-made, it is important that your family be prepared. We touched a couple weeks back on how simple pieces of technology can keep your home safe from burglary. Well, wouldn’t it be great if technology could help us avoid other claims like water damage, fire & freezing damage?

We touched a couple weeks back on how simple pieces of technology can keep your home safe from burglary. Well, wouldn’t it be great if technology could help us avoid other claims like water damage, fire & freezing damage? Ah, summer. A time where we enjoy the great outdoors and most often take our vacation for the year. Whether you’re traveling close to home on a short camping trip or headed off to Europe with the drones of other tourists, keeping your home safe while you’re away can be as simple as not doing anything differently. Ponder these points to keep your home safe from burglary while on vacation:

Ah, summer. A time where we enjoy the great outdoors and most often take our vacation for the year. Whether you’re traveling close to home on a short camping trip or headed off to Europe with the drones of other tourists, keeping your home safe while you’re away can be as simple as not doing anything differently. Ponder these points to keep your home safe from burglary while on vacation: So, you’ve got an Amazing Fantasy #15 comic book – the first appearance of Stan Lee’s Spider Man in a safe from when you were just a kid. What you probably know is that this item can be worth tens of thousands of dollars, but what you probably don’t understand is what happens if that item is lost, stolen or destroyed by a disaster in your home.

So, you’ve got an Amazing Fantasy #15 comic book – the first appearance of Stan Lee’s Spider Man in a safe from when you were just a kid. What you probably know is that this item can be worth tens of thousands of dollars, but what you probably don’t understand is what happens if that item is lost, stolen or destroyed by a disaster in your home. For years we have all been flooded with auto insurance commercials talking about various discounts offered in the insurance industry for auto insurance. There are the standard ones: multi-policy, multi-vehicle, etc., but there may be some other discounts that drivers are not aware of. We have compiled some of the additional insurance discounts offered by various insurance companies. Could you be saving money with these discounts? Be sure to ask your local insurance agent about special discounts that may apply to your specific situation. These discounts vary by state, so it is best left to a local agent to let you know which ones apply.

For years we have all been flooded with auto insurance commercials talking about various discounts offered in the insurance industry for auto insurance. There are the standard ones: multi-policy, multi-vehicle, etc., but there may be some other discounts that drivers are not aware of. We have compiled some of the additional insurance discounts offered by various insurance companies. Could you be saving money with these discounts? Be sure to ask your local insurance agent about special discounts that may apply to your specific situation. These discounts vary by state, so it is best left to a local agent to let you know which ones apply. Every time you rent a moving truck, you are faced with the question, “do you want to buy insurance?” The answer to needing insurance or not really depends solely on the size of the vehicle (in addition to what coverage you currently carry, of course) as well as whether or not it is even a vehicle.

Every time you rent a moving truck, you are faced with the question, “do you want to buy insurance?” The answer to needing insurance or not really depends solely on the size of the vehicle (in addition to what coverage you currently carry, of course) as well as whether or not it is even a vehicle.